THIS WEEK’S FUNDING NEWS OVERVIEW

For the past week’s funding news overview, we recommend reading our weekly #DoneDeal newsletter 👇

👀 Are you interested in funding news from the FinTech space?

💡 Read all about it in my weekly overview article and get the latest funding news from the global FinTech space in your inbox every week.

👀 NEWS HIGHLIGHT

Onyx Private announced $4.1 million in new funding to provide private banking and investment services specifically tailored to high-earning Millennials and Gen Zers.

📊 INFOGRAPHIC

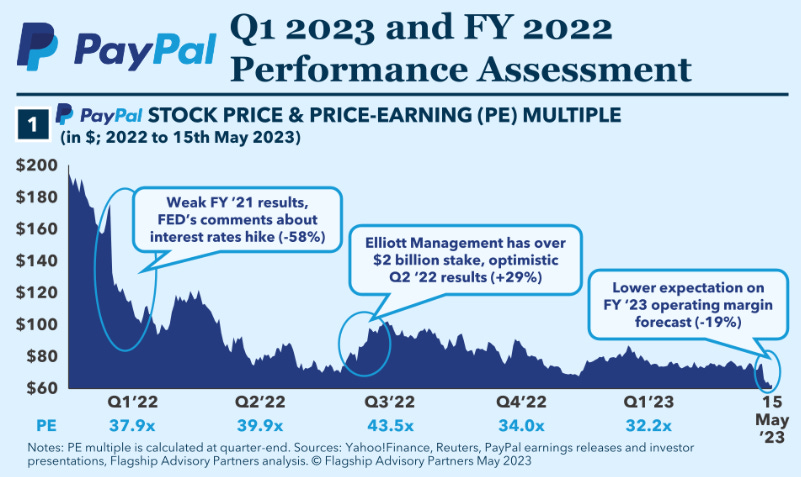

PayPal Q1 2023 and FY 2022 Performance Assessment

‣ PayPal lost ~$155 B in market cap with ~70% decline in share price since Jan ’22.

‣ Share price hit a 6-year low on 12 May this year.

‣ Pace of M&A clearly slowing with potential for divestitures.

📰 ARTICLE

As the crypto market endures a downturn, established financial services companies like Mastercard, PayPal, and Robinhood are launching initiatives to make the sector more accessible and stimulate user adoption.

💡 INTERVIEW

Visa is digging deep into the cryptocurrency space. In an interview with Blockworks, Visa’s head of CBDC and protocols, Catherine Gu discussed the company’s current exploration of blockchain protocols and consensus mechanisms.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🇺🇸 NATIONAL HIGHLIGHTS

⭐️ QED Investors raised $925 million for two new funds.

⭐️ Daylight is set to shut down on June 30.

⭐️ Fifth Third Bancorp acquired Rize Money.

⭐️ PayPal is reportedly mulling a sale for its cross-border payment unit Xoom.

⭐️ The founder of Monzo Bank has quit London in favor of San Francisco as he said the US was “much more accepting” of tech companies than Britain.

😇 Do you want to have access to the best deal flow in FinTech? And/or do you want to invest alongside me and 1000+ other FinTech Angel investors?

Join my Angel Investors Syndicate!

DIGITAL BANKING

Customers of Dave have collectively earned more than $1 million from Dave’s new in-app survey-taking feature.

Plenty secures $2.75 million to revolutionize wealth creation for modern couples.

Meridian Bank partners with Corserv to launch a new credit card program for its business and commercial customers.

Bank of America launched an accelerator program to support entrepreneurs from underrepresented communities.

Sonata Bank has tapped Plinqit to help restaurant workers save and plan for their financial goals.

PAYMENTS

Venmo is introducing a new service that allows parents to open a Venmo account for children between the ages of 13-17 to send and receive money via the app.

Mode Eleven announced its partnership with Finzly in order to implement its solutions for ACH operations and wire processing.

Visa and MasterCard agree to lower the average credit card interchange fee below 1%. The deal will on average reduce the typical fee that a merchant pays by 27 %.

Block-owned Square rolled out a Square for Franchises platform, allowing franchisors to monitor multiple units using the dashboard.

Bitpay halts its prepaid Mastercard program, rendering the card unusable for Bitpay Mastercard holders after the specified deadline.

Kroger began rolling out support for Apple Pay - its decision might finally sway Walmart to do the same.

Episode Six announced a $48 million Series C financing led by Avenir.

SOFTWARE DEVELOPMENT

Prism Data partners with Plaid, allowing Prism to deliver a more efficient cash flow experience for its clients by enabling them to retrieve data simply and securely.

OPEN BANKING

Moven adds digital wealth management tools with Atomic, allowing users to allocate savings into fully diversified portfolios with benefits like direct indexing, tax-loss harvesting, and ESG investing.

INVESTMENT

Bank of America led a $35 million Series D investment in OpenFin, with significant participation from Pivot Investment Partners and ING Ventures.

CRYPTO

Azteco announced that it had raised $6 million in a seed funding round led by Jack Dorsey.

Crypto companies fleeing U.S. regulatory uncertainty have been offered a welcome in France, by officials boasting a regulatory framework that offers relative predictability.

BLOCKCHAIN / DEFI

Singapore's Monetary Authority and the Federal Reserve Bank of New York explored the use of distributed ledger technology to streamline cross-border payments involving diverse currencies.

FINANCIAL LITERACY

Claro Wellbeing launched the UK’s first financial well-being program that offers accessible financial education to frontline and deskless workers over WhatsApp.

MOVERS & SHAKERS

Pipe appointed Namrata Ganatra as Chief Product and Technology Officer, Scott Polchleb as Chief Innovation Officer, Manpreet Dhot as Chief Risk Officer, and Yasmin Moaven was promoted to both COO and CMO.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.