REPORT

The business-to-business (B2B) market remains one of the last major global opportunities for payment digitization.

Not only is the market still plagued by widespread manual processes and inefficient payment methods, but it is also a massive market estimated at nearly $29 trillion in the U.S. alone.

👉 Download the full (380+ page!) report here.

REPORT

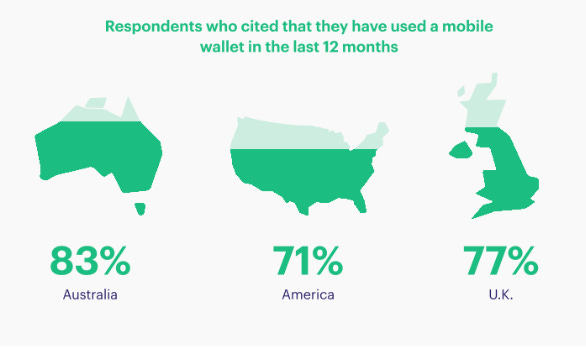

In partnership with Propeller Insights, Marqeta conducted a survey of 4,000 consumers across three continents, including 2,000 in the US, to get a sense of current consumer purchase preferences and how they want to pay, bank, and shop.

According to the survey, US consumers who reported using a mobile wallet in the past 12 months increased from 64% in late 2020 to 71% in 2022.

👉Download the full report here.

👀 NEWS HIGHLIGHT

Affirm teams up with Stripe as the BNPL wars intensify.

The deal is significant for Affirm because Stripe, which was valued at $95 billion last year, has “millions” of customers. It processes hundreds of billions of dollars each year for “every size of business — from startups to Fortune 500s.”

👉Read the full Techcrunch article here.

😎 SPONSORED CONTENT

Join Sokin for free. Enjoy straightforward, transparent global money transfers at the swipe of a screen and click of a button with no hidden charges or commissions – just unlimited transfers for a fixed monthly fee. Download the Sokin app from the Apple App Store or Google Play Store today.

📊 INFOGRAPHIC

Gallup finds 58% of Americans reporting that they own stock, based on its April Economy and Personal Finance survey.

This is slightly higher than the 56% measured in 2021 and 55% measured in 2020 but is not a statistically meaningful increase.

👉Read the full article, with more facts and figures here.

📰 ARTICLE

Paysend has announced that it has grown its customer base in the United States by 66% in the past 12 months, to more than 500,000.

Jairo Riveros, Chief Strategy Officer and Managing Director of North America and LATAM at Paysend said: “Latin American nations and the Caribbean have seen record remittance flows in the past year, rising over 25% according to the World Bank. As more and more people in the U.S. and Latin America require services to help them send funds.”

👉Read the full Crowdfund Insider article here.

💡INSIGHTS

Cash App has been the #1 finance app in the App Store for five years running, has 80 million users, and last year was the 8th-most-downloaded app in the U.S. across all categories.

Read this great full deep-dive article by Rex Woodbury below.👇

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🇺🇸 NATIONAL HIGHLIGHTS

⭐️As Klarna plans to lay off 10% of its workforce, rival fintech firms Revolut and Wise say they're hiring for hundreds of open roles. Link here.

⭐️The wildlife of billionaire Twitter founder and 'Block Head' Jack Dorsey. Link here.

⭐️Pebble raised USD6.2M in funding. Link here.

⭐️Captain announced its ‘Build Now, Pay Later for Deductibles’ feature for homeowners’ insurance deductibles. Link here.

⭐️Haven Life and Kinly are announcing a new partnership to make term life insurance more accessible to Black Americans. Link here.

😇 Do you want to have access to the best deal flow in FinTech? And/or do you want to invest alongside me and 1000+ other FinTech Angel investors?

👉 Join my Angel Investors Syndicate!

DIGITAL BANKING

Mambu and Brim Financial announced a strategic partnership to deliver a modern, more powerful digital banking, deposit, lending, and cards platform across Canada and the U.S. Link here.

Save announced that they have signed an agreement with Webster Bank. Webster Bank will make savings accounts available to Save customers who participate in this product offering on Save's innovative Savetech platform. Link here.

VC FUNDS

PayPal Venture and Experian Venture invest in home rental fintech Jetty. The new funding will enable Jetty to accelerate the growth of its existing suite of products and invest in product expansion. Link here.

PAYMENTS

Melio announced the launch of international payments, enabling U.S. small businesses to make payments abroad with ease and build resiliency in their supply chains. By July 1, Meliocustomers will be able to pay suppliers in over 70 countries, including main import markets. Link here.

Tandym launched backed by $60 million in venture capital funding, aiming to help retailers recoup the cost of accepting credit cards by funding merchants’ own loyalty programs. Link here.

BNPL

Prove Identity, Inc., the leader in digital identity, recently announced it has joined the Visa ready for BNPL program. Link here.

OPEN BANKING

Banktivity teamed up with Salt Edge to enable its customers in the UK and EU to connect their bank accounts and have all their financial data pulled into the app instantly and fully digitally. Link here.

2021 was a year of great progress for Open Banking across the EU and UK.

The regions witnessed strong growth both in the volume of API calls and the number of third-party providers (TPPs). Link here.

CRYPTO

ZenLedger closed a $15M Series B funding. The company intends to use the funds to expand services globally, innovate further on crypto finance products, and grow retail and government market share. Link here.

MOVERS & SHAKERS

Drivewealth hired Visa's former crypto and fintech exec, Terry Angelos, as the new global CEO, replacing founder Bob Cortright, who will go on to be executive chairman. Link here.

Atomico hires Revolut and Uber executive, Don Hoang. Link here.

Brim Financial has appointed Arthur Zhao as its chief financial officer (CFO). Link here.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.