Ingo Payments Taps Marqeta as Issuer Processor for Embedded Banking

Weekly news up to Thursday, 3rd of April 2025.

👀 NEWS HIGHLIGHT

Klarna’s announcement that it will bring “buy now, pay later” loans to food delivery app DoorDash two weeks ago was intended to showcase the Swedish FinTech’s US growth before its long-awaited initial public offering.

Instead, it triggered a backlash. The tie-up prompted a flurry of jokes on social media with users comparing taking on debt to pay for food deliveries to the subprime loans that caused the last financial crisis.

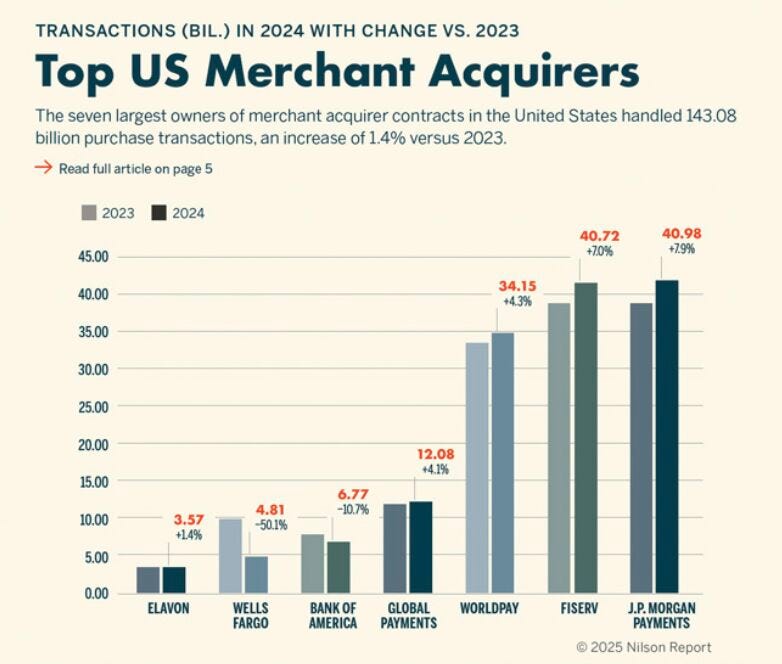

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🇺🇸 NATIONAL HIGHLIGHTS

⭐️ Zelle App Shuts Down Today. Here's How to Send Money Instantly for Free.

⭐️ Chime Enterprise debuts Chime Workplace to boost employee financial wellness.

⭐️ Ex-eBay, PayPal, LendingClub exec joins PayZen as Chief Legal Officer.

⭐️ TransUnion acquires Monevo to expand credit prequalification services.

Subscribe to my Spanish Daily FinTech Newsletter for daily updates and analysis on the evolving world of financial technology—entirely in Spanish. Join now and stay in the loop!

FINTECH

CFPB set to ditch BNPL rule. The rule would have required BNPL providers to grant consumers key legal protections and rights similar to those of conventional credit cards. These include the right to dispute charges and request a refund from the lender after returning a product purchased with a buy now, pay later loan.

Jury rules startup founder Charlie Javice guilty of defrauding JPMorgan Chase. The verdict against her came after approximately four hours of jury deliberation. It wrapped up roughly five weeks of testimony where prosecutors claimed that Javice and co-defendant Olivier Amar lied and created fake customer data to sell their financial aid company, Frank, in 2021.

PAYMENTS

NMI launches Tap To Pay on Google Play Store. NMI’s Tap to Pay solution gives its partners a simple way to help merchants and small businesses accept payments on the Android smartphones or tablets they already use, eliminating the expense and complexity of deploying traditional point-of-sale equipment.

TreviPay unveils B2B purchase controls to enhance compliance. The new feature enables companies to enforce customised purchase policy structures that align with their internal requirements. Businesses can reduce payment delays, decrease manual reconciliation work, and improve compliance.

Yuno rolls out Ethoca Alerts to improve the consumer experience. The feature enables merchants to resolve transaction disputes before they escalate into chargebacks. This tool further strengthens Yuno’s end-to-end payment solution by helping merchants to take back control, save on costs, and improve efficiency.

REGTECH

FDIC says banks can engage in crypto activities without prior approval. The Federal Deposit Insurance Corporation announced that banks can engage in legally permitted activities, including those that involve cryptocurrency, without receiving prior regulatory approval, if they manage risks properly.

Trump’s stablecoin push set to collide with banks. With banks and crypto companies fighting to influence the rules, the president launched his own stablecoin, effectively threatening to take business away from both industries. Read more

DIGITAL BANKING

Chime launches Premium Membership Tier and more than a dozen New Features. Chime+ is a free premium membership available to members who set up a qualifying direct deposit. It provides a broader range of financial tools, perks, and services like MyPay® and SpotMe®.

CRYPTO

Coinbase breaks new ground with MPC security technology. The company is open-sourcing its Multi-Party Computation (MPC) cryptography library. MPC functions like a safe that requires multiple combination codes, where each participant knows only their part of the code and never shares it with others.

Crypto.com probe by the SEC has officially closed, says CEO Kris Marszalek. “We are pleased that the current SEC leadership has decided to close its investigation into Crypto.com,” said Crypto.com’s CLO, Nick Lundgren, in a statement, which accused the previous administration of abusing its authority to harm the crypto industry.

FTX to start paying main creditors’ bankruptcy claims in May using a cash hoard of $11.4 billion. The firm's main creditors include investors owed millions of dollars as well as institutions that had crypto on the FTX platform. Keep reading

Circle hires banks for long-awaited IPO. The FinTech is working with investment banks JPMorgan Chase and Citi on its long-expected IPO. The precise timing for the listing is unclear, but the sources said Circle aims to publicly file paperwork for the offering in late April.

Coinbase security under fire after $46M phishing attacks. ZachXBT has been tracking a series of significant thefts, including one particularly alarming incident from a single Coinbase wallet. The stolen funds were swiftly moved across multiple blockchains, significantly complicating efforts to trace and recover them.

PARTNERSHIPS

Ingo Payments selects Marqeta as issuer processor for enhanced embedded banking platform. Ingo selected Marqeta for its flexible, scalable technology stack that helps its customers develop innovative financial products and bring them to market quickly. By partnering with Marqeta, Ingo is equipped to drive the next generation of issuing solutions, offering value to senders, receivers, and businesses alike.

Airwallex & Yuno join forces to revolutionize global payments. This collaboration strengthens Yuno’s financial services and payment capabilities, helping businesses streamline their global transactions. For Airwallex, it enhances the company’s ability to support larger enterprises with more efficient and scalable cross-border payment solutions.

QorPay integrates with Visa’s Cybersource to support secure payments. By leveraging Visa’s technology, QorPay enables clients to simplify transactions, mitigate fraud risks, orchestrate data, and optimise expense management through a unified dashboard.

DONEDEAL

Sam Green’s Cambrian secures $5.9M to revolutionize AI-powered finance. Green is taking a major step forward with his latest venture, Cambrian. With this funding, Cambrian is poised to lead the agentic finance revolution, empowering AI to navigate complex markets with certainty and efficiency.

MOVERS & SHAKERS

OKX Chief Legal Officer Mauricio Beugelmans leaves the exchange. Beugelmans stated that he left OKX to pursue another opportunity within the crypto industry, which he plans to share publicly at the appropriate time. He added that it was a privilege to scale and lead such a talented team of legal and professionals.